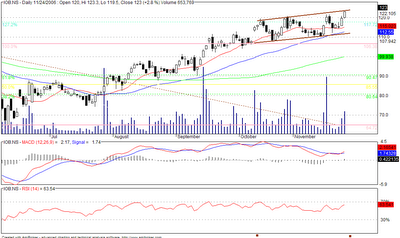

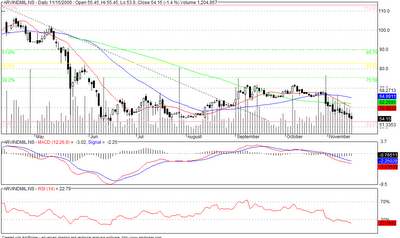

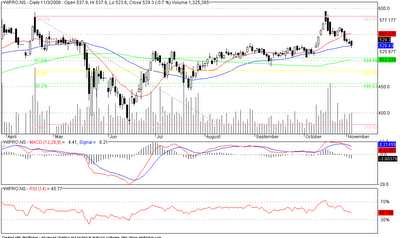

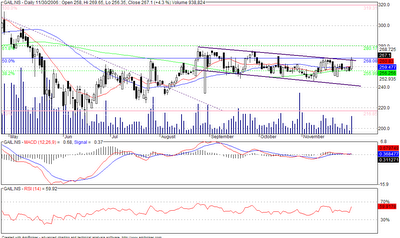

GAIL - Upper Channel

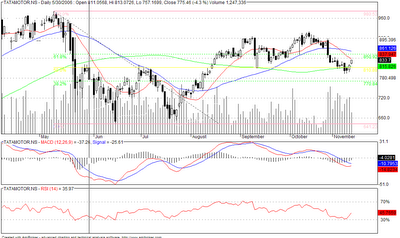

GAIL has reached the upper channel. The stock has been languishing at these levels for more than 3 months now. The stock has not on comparitive terms done on fairly higher volumes when compared to the previous few trading sessions. The stock is yet to provide any signal from any of the charts. However, the following needs to be noted

- The price is moving on a channel. The stock has now reached its upper level of the channel and there is a nice opportunity of the stock looking at either side of the channel. However, history of this stock if one takes the past 3 months as a base, this does not look like a good possible.

- MACD is still not on the strong side to provide with a 'buy' signal

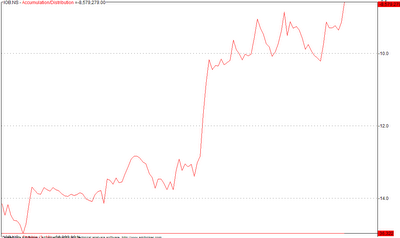

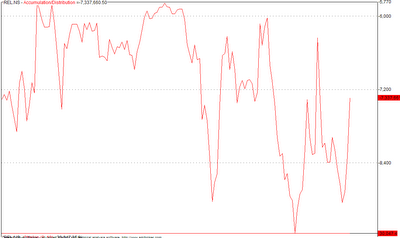

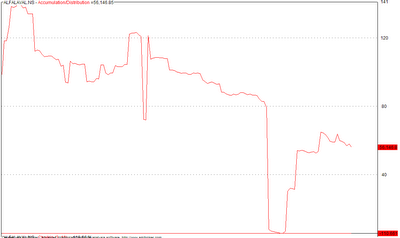

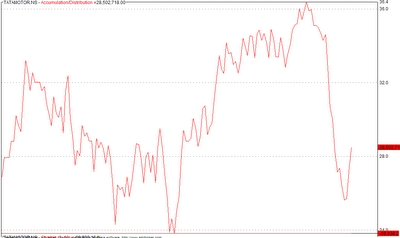

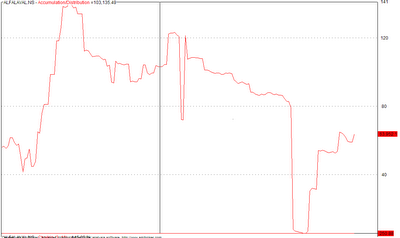

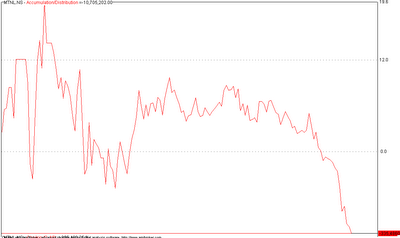

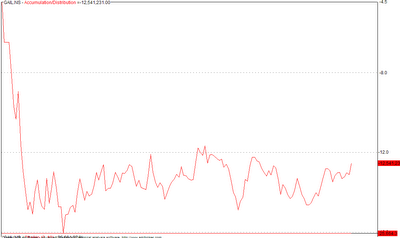

- The Accumulation Distribution chart is probably an interesting one to look at. Unlike a Dr. Reddys where we have seen heavy selling in the stock. This stock has not done anything of that sort. There is neither strong accumulation on downsides or heavy selling on upsides. This provides some sanity of the strength of the stock at these levels.