Ashok Leyland - Consolidation

Ashok Leyland achieved its target of Rs. 50 in the second week of October. The stock has since seen a good correction of approximately 12%.

- Though not a proper downward line formation, the stock looks to be following a nice trend on the downside. The upper and the lower lines on this stock gives an indication of the maximum expected movement on a daily basis. Given this formation the stock is all set to reach its first support levels of Rs. 43 in the next couple of days.

- The MACD chart has supported this downward movement and the columns are still rising on the negative side. RSI is still not in a strong 'buy' zone for the stock.

- The stock consolidates at certain levels and then takes a movement which is quite sharp. At both the 50% and the 61.8% levels, the stock did consolidate for a week or so, before the next rally.

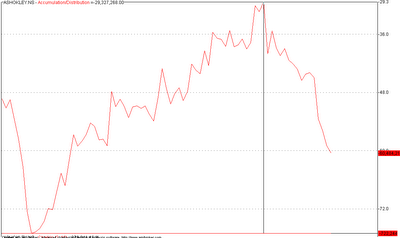

- Accumulation - Distribution chart is showing strong volumes on declines.

0 Comments:

Post a Comment

<< Home