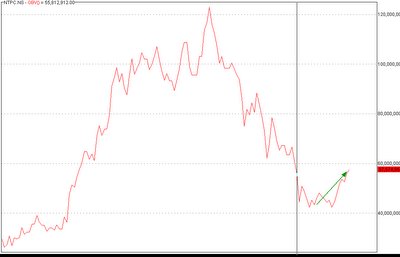

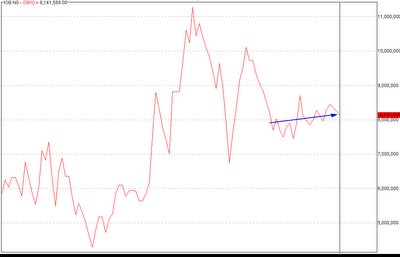

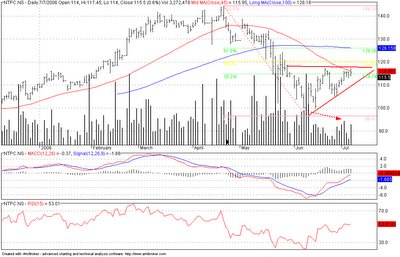

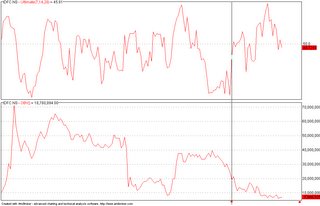

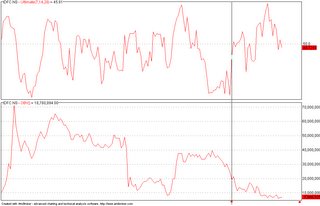

IDFC has entered into a symetrical triangle. This type of triangles are normally not indicative of the future trend until there is a clear breakout. The stock did a low of 45 on May 22 and then has entered into this triangle and since then RSI has shown some strength. As this does not take the volume under consideration, I have used the OBV indicator to define the strength of this movement within the triangle.

Also if one looks at the OBV, which is a volume indicator, it is pretty disappointing. The stock is seeing movement on reducing volumes... Buying has drastically reduced in this stock and infact is losing strength. At this point I would be a bit hesitant to take calls on the stock.

Lets see how this stock pans out in the near future.

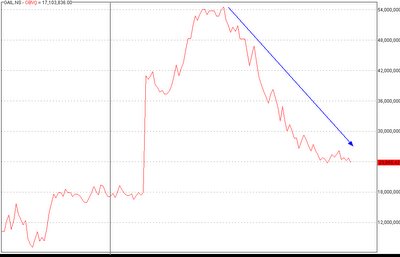

Ashok Leyland has entered into an interesting phase for the following

Ashok Leyland has entered into an interesting phase for the following