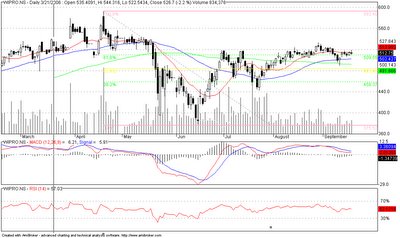

PTC - Entering into Support Zone

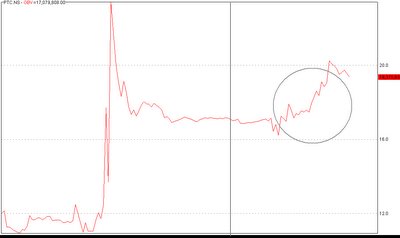

PTC is entering into support zone at these current levels as shown in the picture above. From a high of Rs. 82 in May, the stock corrected quite sharply to a low of Rs. 45 in June. The stock has subsequently rallied to a high of Rs. 65 before correcting back to current levels of Rs. 56.

- The stock is currently playing between Rs. 55 to Rs. 60 range.

- MACD is on a sell signal and with an increasing bar columns, indicating some weakness.

- RSI is close to a very comfortable zone at 46.

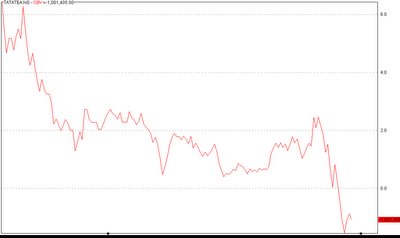

- The OBV indicator is a good leading indicator for this company at these levels. In the trading zone, that has been marked with a rectangle, look at the corresponding circle in the OBV chart. There has been significant amount of purchases at that zone.

- The stock is currently at a strong zone even without the rectangle in consideration. The stock was in this zone from December to May before the huge break-out.