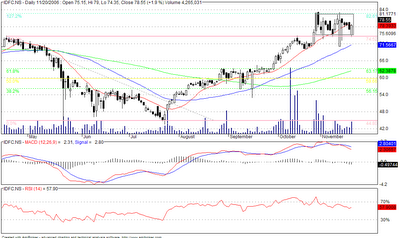

IDFC - Rangebound

IDFC is still moving with some range bound movement. What still remains is the direction of the next set series. The stock had a strong rally since mid-September. Having completely retraced to its previous high in April, the stock rallied further to 127% before entering into a range between 100% and 127%.

- MACD is showing increase in the size of the column bars. Not a good indicator for an investor of the stock.

- RSI is still in a zone of 'sell'

- Accumulation Distribution is where there seem to some divergence to the current signals. In spite of the recent fall, the volume is increasing in this stock, in spite of the recent correction in the stock

0 Comments:

Post a Comment

<< Home