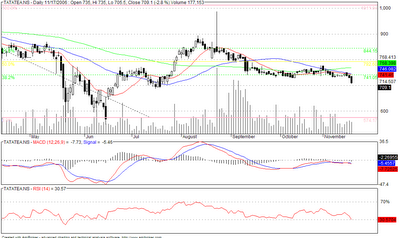

Tata Tea - Negative Breakout

Tata Tea finally could not hold any longer. It has tried holding its support line for more than a month now but finally it broke : "But broke the support line" . 740-730 was a crucial price for the stock to maintain. However with the current price at Rs. 709, the stock looks to have broken the support.

- MACD is still unclear for the signal to give on the stock but looks like the signal would be clear in the next few days.

- RSI though is on the oversold side. This could worsen further, if the stocks still has some pace in the downfall.

- Accumulation Distribution chart is similar to Dr. Reddys, mentioned yesterday. Moving down across time.

0 Comments:

Post a Comment

<< Home