Havells

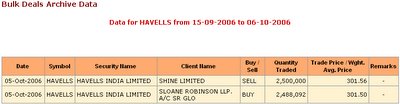

There was a big block deal yesterday which caught my attention. The stock has been hovering at around 270-290 range for sometime before a recent spurt in prices by approximately 15% . I just checked if it makes sense to take a decision on this stock.

- The MACD showed the jump that was expected in this movement. It is also increasing giving an indication of some strength.

- RSI has jumped to more than 70 - sign of weakness but there is an indication in the past that the stock can rally for some sustained period inspite of being in the higher side (if one looks at April-May)

The stock jumped on the block deal that happened two days back. The price at which it was struck is at 301.5 well below the current price of 332.

The stock jumped on the block deal that happened two days back. The price at which it was struck is at 301.5 well below the current price of 332.The stock has been a good player in the infrastructure segment, a segment that has not rallied closely with the index. However, the stock has reached where it has just broken its 61.8% levels of the great fall in May. The current upside in the stock is around 10% to reach its next resistance levels. So, you have the prices on hand now. A possible upside to 370 and possible downside to 298-300.

0 Comments:

Post a Comment

<< Home