Ingersoll Rand - Slight Correction

Ingersoll Rand has corrected by more than 8% from its previous high of 355 it achieved last week. The stock jumped too fast and with a few gaps in the process of this rally. The stock's correction looks like it is trying to cover some of the gaps created in the rally.

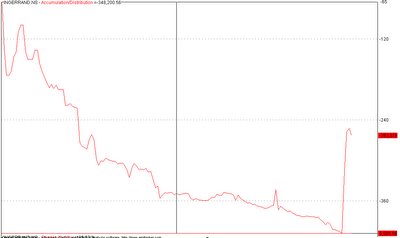

- The stocks volume has not been too encouraging to define a proper correction in the stock. This is reflected in the movement in the Accumulation Distribution chart. The volume has reduced only marginally in the 8% correction.

- The MACD is also on a strong positive zone, though with this correction, it has still yet to give a 'sell' signal.

0 Comments:

Post a Comment

<< Home